GSTR-1 Form and Format

Form GSTR-1 is a statement in which a regular dealer needs to capture all the outward supplies made during the month. Broadly, the GSTR 1 format requires - all the outward supplies made to registered businesses (B2B) to be captured at invoice level, and supplies made to unregistered business or end consumers to be captured at a rate-wise level. However, in certain exceptional scenarios, even B2C transactions are required to be captured at the invoice level.

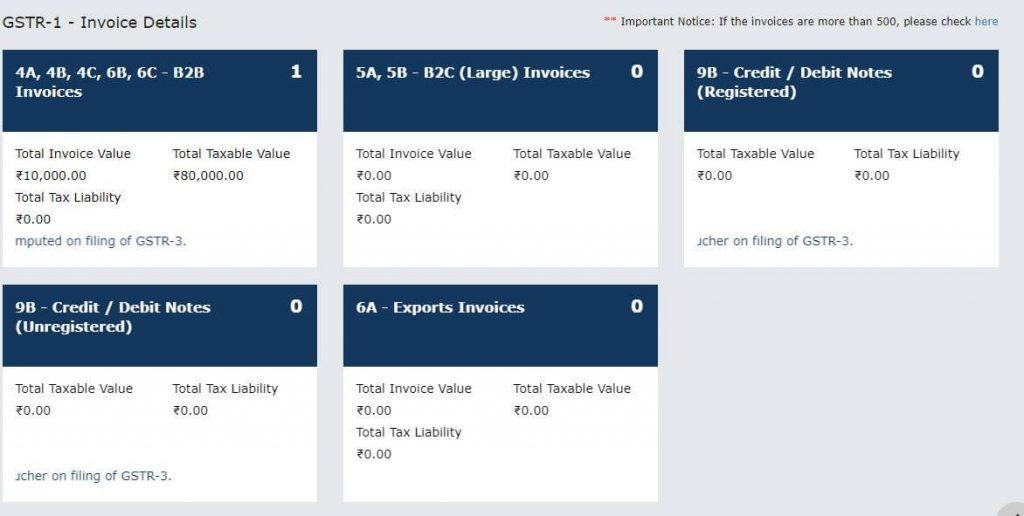

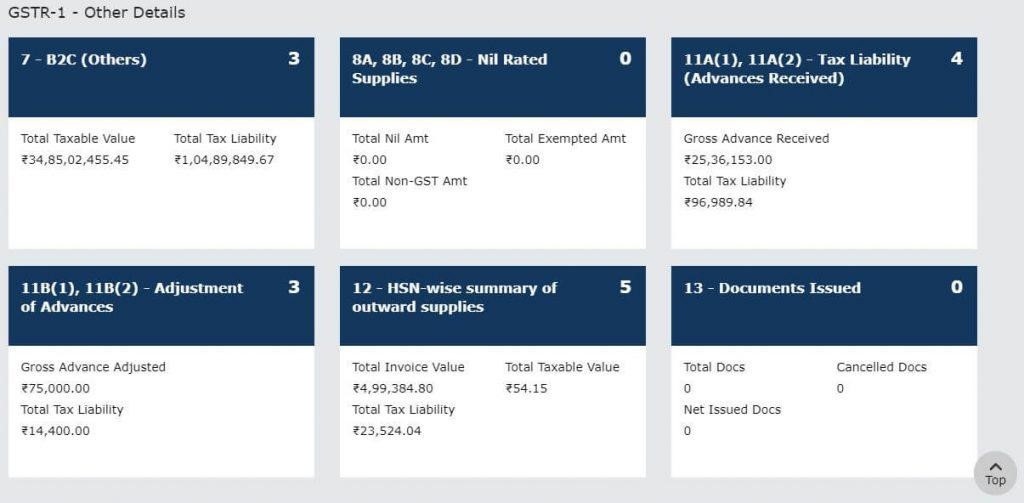

Form GSTR-1 contains 13 tables in which the outward supplies details needs to be captured. Based on the nature of business and the nature of supplies effected during the month, only the relevant tables are applicable, not all. The GSTR-1 format in GST portal is as follows:

|

|

How to file GSTR-1 form?

The GSTR-1 form consists of the following tables in which the details of outward supplies need to be furnished by the registered businesses.

- Table 1, 2 & 3: Details of GSTIN and aggregate turnover in the preceding year

- Table 4: Taxable outward supplies made to registered persons (including UIN-holders) other than zero-rated supplies and deemed exports.

- Table 5: Taxable outward inter-State supplies to un-registered persons where the invoice value is more than INR 2.5 Lakh.

- Table 6: Details of zero rate supplies and deemed exports.

- Table 7: Details of taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies covered in table 5.

- Table 8: Details of nil rated, exempted and non-GST outward supplies.

- Table 9: Details of debit notes, credit notes, refund vouchers issued during the current period and any amendments to taxable outward supply details furnished in the GSTR-1 returns for earlier tax periods in table 4, 5 & 6.

- Table 10: Details of debit note and credit note issued to unregistered person.

- Table 11: Details of advances received/advance adjusted in the current tax period or amendments of information furnished in the earlier tax period.

- Table 12: HSN-wise summary of outward supplies.

- Table 13: Documents issued during the tax period

- Contact us for AUS Experts Advice :-

📞+91-9990976958

or File your GSTR 1 return by uploading your documents and with click file now option & "GET RELAXED "AUS Experts Team will do the rest all workings with maintain your accounting data on a leading Accounting Software's Tally Prime /Busy Accounting Software.